Finance our courses thanks to the apprenticeship tax

Apprenticeship tax: an essential resource for ISFA

- It contributes in a great extent to the realisation of our ambitious projects, to maintain our school amongst the most competitive in the field of actuarial sciences and insurance and financial risk management.

- Moreover, it stands for our ever growing proximity with the business sphere.

- Indeed, our vocation is to train the collaborators who will contribute towards the performance of your businesses of tomorrow and the better comprehension of its risks.

- Finally, it allows us to keep reasonable tuition fees for as many of our students as possible (basic university registration fees) and enable the training of deserving students, without distinction of financial resources.

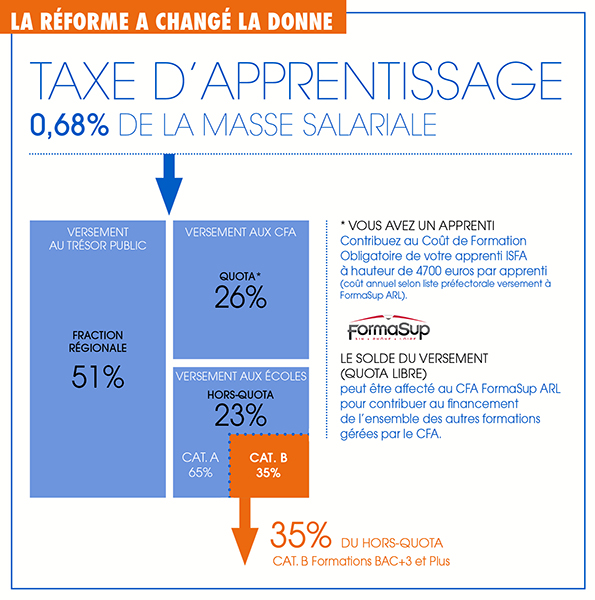

Allocate your OUT-OF-QUOTA Category B directly to ISFA

Code UAI 0693781K

… It is this proportion of your apprenticeship tax which allows us to support our school’s projects

ISFA is accredited to receive the out-of-quota Category B sums

ISFA is accredited to receive the out-of-quota Category B sums1. Speak to the apprenticeship tax collecting organisation (OCTA) of your choice: they will provide the apprenticeship tax declaration slip.

2. Allocate your apprenticeship tax on the apprenticeship tax slip by stating that for out-of-quota Category B: ISFA – Université Lyon 1 – 50 avenue Tony Garnier 69007 Lyon – n°UAI 0693781K

3. Inform us of your payment intentions and state the name of your OCTA: this step is crucial to trace your dossier and to ensure the reception of the funds by ISFA, in accordance with your wishes.

Deadline date for payment: 28 February 2017

What motivated you to allocate your apprenticeship tax to ISFA?

Laeticia MORTREUIL, HR Manager at MERCER Consulting France

It is important for us to contribute towards the training of our future actuaries. ISFA’s cross-disciplinarity, its excellence, its dynamism, its know-how and its knowledge of the business world make the school a prime target.

Catherine PIGEON, Managing Director of AXERIA Prévoyance

Each year we take on several ISFA interns, it therefore seems normal to support the school. Generally, our policy is to allocate the apprenticeship tax to the different schools from which we take our interns.

Anne MARION, Actuary, CEO and Founder of ACTUARIELLES

I have always allocated the apprenticeship tax to ISFA for the simple reason that, having been trained by this institute, it seems only normal to give something back.

En chiffres

300€

the tuition fees, per student, for a year’s training at ISFA

2/3

of our own resources come from the apprenticeship tax

4700€

the annual training cost per apprentice

the tuition fees, per student, for a year’s training at ISFA

2/3

of our own resources come from the apprenticeship tax

4700€

the annual training cost per apprentice

en

en fr

fr